Clark Wealth Partners Fundamentals Explained

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Table of ContentsClark Wealth Partners Fundamentals ExplainedThe Facts About Clark Wealth Partners UncoveredThe Facts About Clark Wealth Partners UncoveredAbout Clark Wealth PartnersExcitement About Clark Wealth PartnersIndicators on Clark Wealth Partners You Should KnowClark Wealth Partners Can Be Fun For Everyone

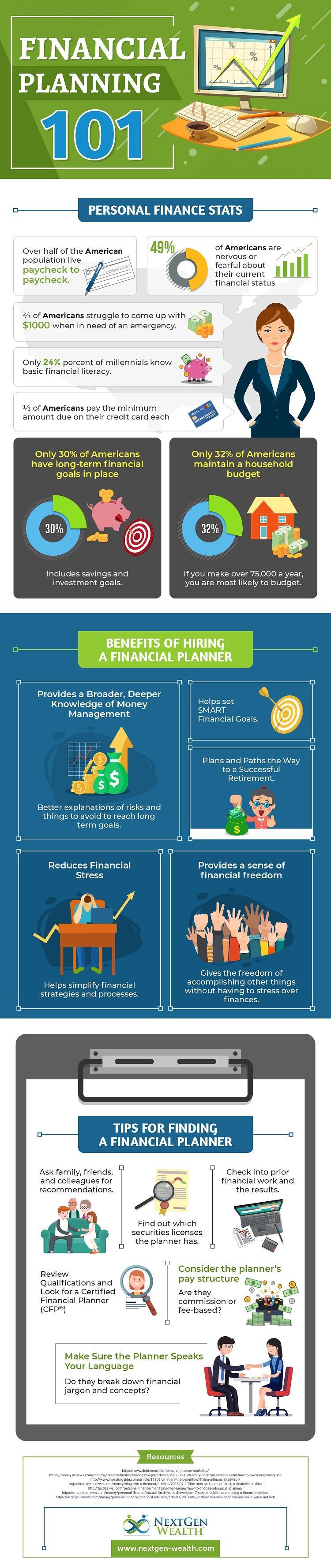

The world of financing is a difficult one., for instance, recently found that almost two-thirds of Americans were unable to pass a standard, five-question financial literacy test that quizzed individuals on topics such as passion, financial obligation, and other fairly standard concepts.Along with handling their existing clients, economic experts will certainly typically spend a fair amount of time weekly meeting with prospective customers and marketing their services to preserve and grow their organization. For those considering becoming a financial consultant, it is important to take into consideration the typical income and task stability for those operating in the area.

Programs in tax obligations, estate planning, investments, and threat monitoring can be helpful for trainees on this path. Depending on your distinct occupation goals, you might likewise need to gain certain licenses to meet particular clients' demands, such as buying and marketing supplies, bonds, and insurance coverage. It can additionally be useful to earn a qualification such as a Licensed Economic Planner (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

The Main Principles Of Clark Wealth Partners

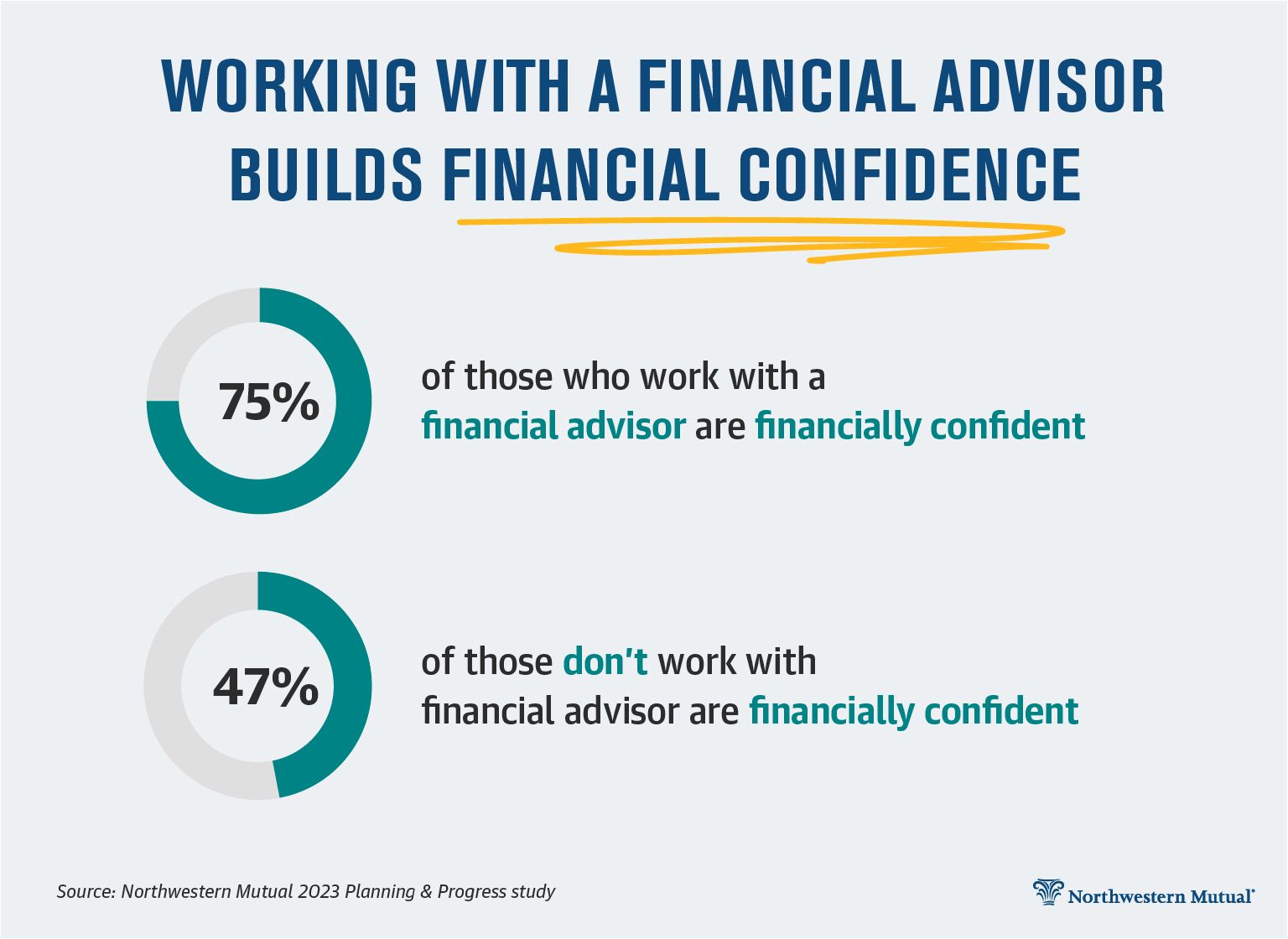

What that looks like can be a number of things, and can vary depending on your age and stage of life. Some individuals stress that they need a specific amount of cash to spend before they can obtain help from an expert (civilian retirement planning).

Getting My Clark Wealth Partners To Work

If you have not had any experience with a financial consultant, here's what to anticipate: They'll begin by giving a complete assessment of where you stand with your assets, responsibilities and whether you're meeting standards compared to your peers for cost savings and retirement. They'll assess short- and long-term goals. What's helpful regarding this action is that it is individualized for you.

You're young and working full-time, have an automobile or more and there are student finances to settle. Right here are some feasible ideas to help: Develop great financial savings practices, settle financial debt, set baseline objectives. Repay pupil loans. Relying on your career, you may qualify to have component of your college loan forgoed.

The Best Guide To Clark Wealth Partners

After that you can talk about the next finest time for follow-up. Before you begin, inquire about rates. Financial consultants normally have various tiers of prices. Some have minimal property degrees and will certainly bill a cost generally a number of thousand bucks for creating and adjusting a plan, or they might charge a flat fee.

You're looking in advance to your retired life and aiding your youngsters with higher education and learning prices. A financial advisor can provide guidance for those circumstances and more.

The 9-Minute Rule for Clark Wealth Partners

Arrange normal check-ins with your coordinator to modify your strategy as needed. Balancing financial savings for retirement and college costs for your kids can be challenging.

Considering when you can retire and what post-retirement years could look like can produce concerns about whether your retired life savings remain in line with your post-work strategies, or if you have actually conserved enough to leave a heritage. Help your financial expert comprehend your technique to cash. If you are much more traditional with conserving (and possible loss), their pointers ought to react to your fears and concerns.

The Best Guide To Clark Wealth Partners

Planning for wellness care is one of the big unknowns in retired life, and a monetary professional can describe alternatives and suggest whether added insurance policy as protection may be helpful. Before you begin, attempt to get comfy with the concept of sharing your whole financial picture with an expert.

Giving your specialist a full picture can help them create a strategy that's focused on to all components of your monetary standing, especially as you're rapid approaching your post-work years. If your financial resources are basic and you have a love for doing it yourself, you may be great on your very own.

An economic consultant is not only for the super-rich; anybody dealing with major life shifts, nearing retirement, or sensation overwhelmed by monetary choices can profit from specialist support. This write-up checks out the duty of monetary consultants, when you might require to speak with one, and key factors to consider for choosing - https://anyflip.com/homepage/btjzk#About. A monetary advisor is a trained specialist that aids clients manage their financial resources and make educated choices that line up with look here their life objectives

The Buzz on Clark Wealth Partners

In contrast, commission-based experts earn revenue through the monetary products they offer, which might affect their recommendations. Whether it is marital relationship, divorce, the birth of a youngster, occupation modifications, or the loss of a liked one, these events have unique financial ramifications, typically requiring timely choices that can have long lasting impacts.